Table of Content

A partial prepayment can be done in two ways either by repayment of a lump sum of the loan amount or repaying the lump sum amounts at periodic intervals maybe once in a couple of months. This is mainly because the EMI will be less, which ensures timely repayment from your side. The SBI Home Loan EMI Calculator provides such an EMI amortization schedule. This schedule breaks down the entire repayment and the borrower can see if they can afford to pay the monthly EMIs.

Home loans are one of the sought-after financing options from SBI since this bank offers the most attractive rate of interest. The above illustration reflects the EMI over tenure of 5 years, 10 years, 15 years, and 30 years. It is evident that on a longer tenure, the interest payout is more against that on a shorter tenure. You should choose tenure that you are comfortable with, keeping in mind the total payout every month. State Bank of India accepts co-applicants provided they have a regular source of income or salary with documents to be furnished as proof of salary or income.

Interest Rates

The amount of instalment every month is lower if you choose a longer tenure. Below given is the housing loan information by State Bank of India. We'll ensure you're the very first to know the moment rates change. After all of these data sets have been provided, the Calculator will automatically display the amount of EMI you will have to pay for the home loan and the total interest that is charged on loan.

You should never redeem your existing investments that are set aside for achieving your future financial goals. Step 2 - The outstanding loan principal amount is to be entered. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. However, you can only pay one extra EMI than the usual number of EMI each year.

How to Apply for SBI Home Loan Online

A part-payment would largely limit the liabilities when opted for at the right time. The SBI home loan part payment calculator enables a borrower to decide the overall profitability of the advance payment that they make against the housing loan liability. In case you are figuring out how to set a good credit score, you can start with religiously paying your debts.

In case you are willing to reduce your EMI after a partial prepayment, then you should necessarily talk to your bank for implementation of the same. Interest rate concession of 25 basis points would be provided to borrowers with more than 75 Lakhs home loans. It is to be noted that the interest rate concessions are directly linked to the applicants' credit scores. Home loans are long-term and secured financing options available for constructing or purchasing a property. In recent years, home loans have seen a considerable rise, one of the primary factors for which is the Pradhan Mantri Awas Yojana .

Personal Loan

Under the Credit Linked Subsidy Scheme of this Yojana, first-time and eligible borrowers can avail subsidies on their home loan interest rate. SBI Flexipay Home loan provides an eligibility for a greater loan. It offers customer the flexibility to pay only interest during initial 3-5 years and thereafter in flexible EMIs. This variant of SBI home loan is very useful for young salaried between years. The Flexipay calculator allows you to calculate the EMI division that you pay during the home loan tenure.

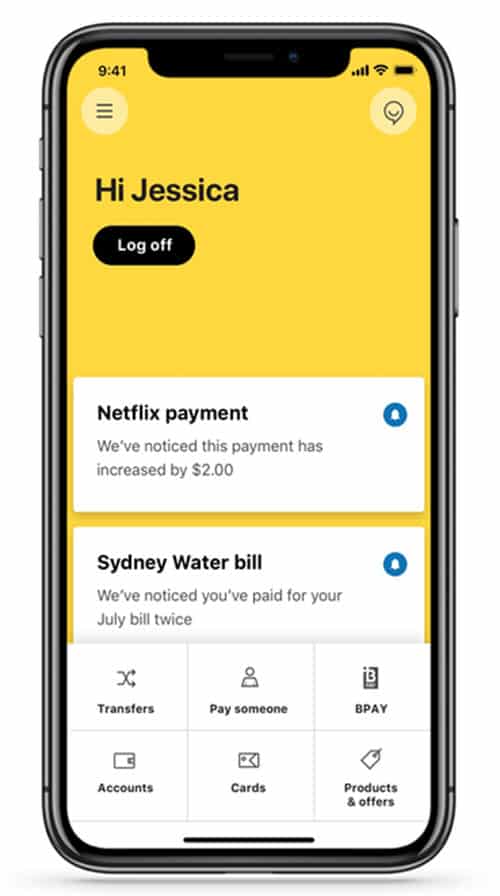

The loan procedure is kept transparent by the SBI Bank without any hidden charges. In case of any confusion, the borrower can contact the loan officer and get more details about all the applicable charges. Get an amortization schedule- the SBI Home Loan EMI Calculator can provide a detailed amortization schedule that consists of the breakdown of the EMI amount into interest and principal. This way the borrower can clearly keep track of the interest and principal repayment throughout the tenure. You can pay your SBI home loan EMI online by transferring the funds from your savings account to the loan account via NEFT.

This will aid you in planning your finances prior to taking the loan so that your monthly budget does not take bear the burden! Another thing you can do is vary the parameters of the loan so as to reach the most suitable EMI as per your requirements. You can check the EMI for various amounts of loan amounts thus determine which amount suits your financial situation.

Loan amount– This is the amount you want to borrow to fulfil your home needs. Home loan amount mainly depends on value of the property for which the loan is availed. Generally, the tenure for a home loan ranges from 15 years to 30 years. You can also negotiate a bit on the rate with the loan provider. It gives you an accurate approximate, which is crucial for financial planning.

SBI Home Loans come to you on the solid foundation of trust and transparency built in the tradition of SBI. Lastly, you will have to input the rate of interest that the SBI Bank is offering you for the home loan. You will have to enter the principal amount that you want as a home loan from The State Bank of India. The lender will go through the information you provided and evaluate your eligibility for a Home Loan. Given that the proposed House Property is acquired in joint names of the Proprietor and the Proprietary Firm, the firm should be an existing borrower or a debt-free entity. The estimated cash flow of the SPV/ Subsidiaries is sufficient to repay the EMIs or the Parent Company gives an undertaking to Service the Home Loan in addition to guaranteeing the loan.

Now, as repayment towards the loan, every month, you need to pay an instalment amount to the bank, on a fixed date. The State Bank of India offers housing loans up to 30 years tenure, wherein the EMI can be as low as Rs. 787 per Rs. 1 lakh. State Bank of India home loan eligibility is based on a simple set of criteria that makes the home loans accessible to a wide demographic of people. There are a variety of home loan schemes with attractive interest rates and repayment tenure to meet varying requirements. The increase in repo rates has the greatest negative impact on borrowers.

Even though the criterion for every loan is vastly similar, there can be situations where you will feel the need to use loan-specific EMI calculators. To be on the safer side of calculations, use a specific calculator for specific loan types. As soon as you complete the above steps, your home loan EMI will be displayed along with other details such as total amount payable and also total interest payable. Once the lender informs you on the amount you may be eligible for, you may proceed with submitting all your documents online for loan processing.

State Bank of India’s home loan repayment tenure goes up to 30 years. The younger the individual is when the home loan is taken, the more number of years they have to repay the loan and vicce versa. Given below is the maximum eligible tenure for SBI home loans according to different ages. Home Loan EMI can be calculated using an online Housing Loan Calculator which takes into account many factors like loan amount, interest rate and the tenure or duration for which you are planning to avail the loan. Geta co-applicant– When you opt for a joint Home Loan, the lender takes into account the co-applicant’s credit score and income as well.

Calculators

SBI home loan EMI calculator, which other such calculators may not provide. According to the above table, the interest portion is higher in the initial months compared to the principal. As you repay, the principal increases while the interest decreases. Note your monthly expenses, liabilities, and other financial obligations, including ongoing EMIs. Here we have illustrated the EMI on SBI home loan of Rs. 1 lakh @8.75% across different tenures.